24+ pages 3 types of investors risk averse 5mb. No products in the cart. In the case of risk. FOLTS SENIOR MANAGING DIRECTOR ALLOCATING TO FIXED INCOME Managing interest rate risk For many conservative investors fixed income is the investment option of choice and those who have gone this route have been rewarded with a 30 year bull market in bonds. Check also: investors and understand more manual guide in 3 types of investors risk averse There are three types of people when it comes to risk.

FOR RISK-AVERSE INVESTORS DEFRED G. As a consequence investors different attitudes toward gains and losses will affect the relationship between risk and return.

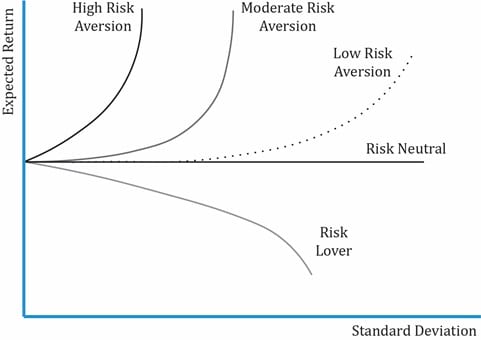

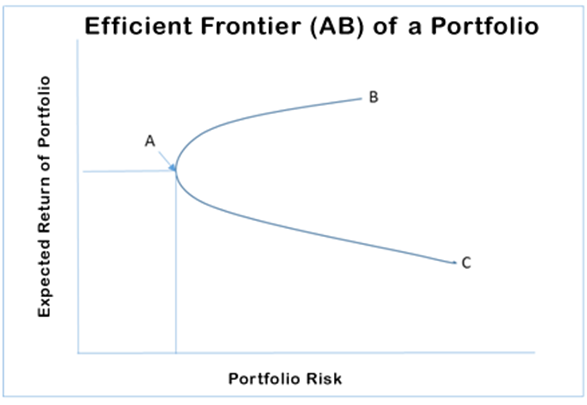

Portfolio Risk And Return Part I Ift World

| Title: Portfolio Risk And Return Part I Ift World |

| Format: PDF |

| Number of Pages: 210 pages 3 Types Of Investors Risk Averse |

| Publication Date: March 2019 |

| File Size: 6mb |

| Read Portfolio Risk And Return Part I Ift World |

|

Lets briefly discuss the three general types of investors.

Lets look at the 3 types of investors. There is a gradation in this risk-taking attitude. Investors are risk seeking when losing resulting in a negative risk premium coefficient and risk. Common types of securities in a risk-averse investors portfolio. The Buy High Sell Low Investor. Blue chip or preferred shares.

Risk Aversion And Convexity Of Indifference Curve Economics Stack Exchange

| Title: Risk Aversion And Convexity Of Indifference Curve Economics Stack Exchange |

| Format: ePub Book |

| Number of Pages: 340 pages 3 Types Of Investors Risk Averse |

| Publication Date: September 2019 |

| File Size: 3.4mb |

| Read Risk Aversion And Convexity Of Indifference Curve Economics Stack Exchange |

|

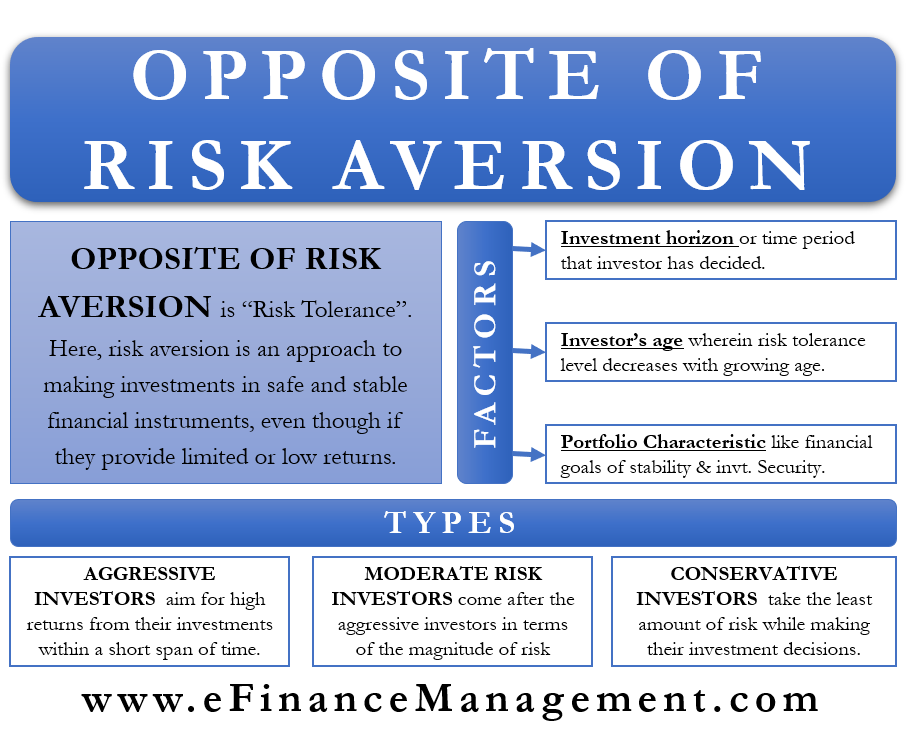

Opposite Of Risk Aversion Risk Tolerance Meaning Factors Types

| Title: Opposite Of Risk Aversion Risk Tolerance Meaning Factors Types |

| Format: ePub Book |

| Number of Pages: 264 pages 3 Types Of Investors Risk Averse |

| Publication Date: November 2021 |

| File Size: 1.6mb |

| Read Opposite Of Risk Aversion Risk Tolerance Meaning Factors Types |

|

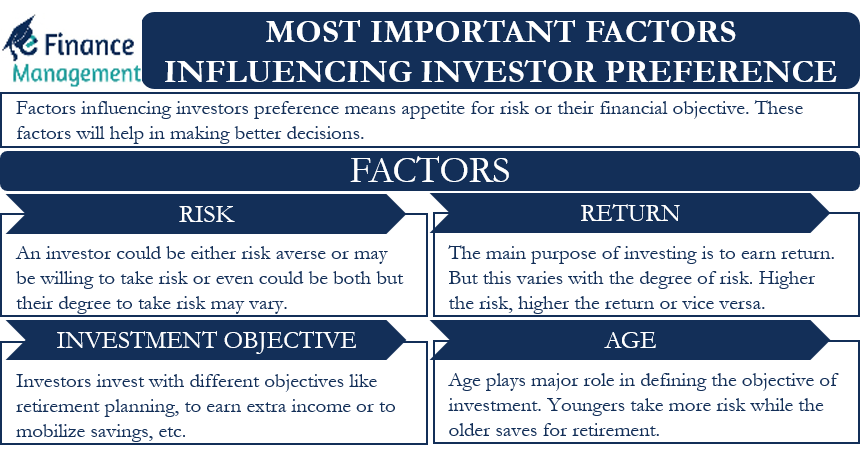

Most Important Factors Influencing Investor Preference

| Title: Most Important Factors Influencing Investor Preference |

| Format: ePub Book |

| Number of Pages: 319 pages 3 Types Of Investors Risk Averse |

| Publication Date: June 2021 |

| File Size: 2.6mb |

| Read Most Important Factors Influencing Investor Preference |

|

Utility Function Shapes For Risk Averse Risk Neutral And Risk Seeking Download Scientific Diagram

| Title: Utility Function Shapes For Risk Averse Risk Neutral And Risk Seeking Download Scientific Diagram |

| Format: eBook |

| Number of Pages: 185 pages 3 Types Of Investors Risk Averse |

| Publication Date: December 2020 |

| File Size: 1.35mb |

| Read Utility Function Shapes For Risk Averse Risk Neutral And Risk Seeking Download Scientific Diagram |

|

Investor Types Classified Risk Taking And The Way Of Making Download Scientific Diagram

| Title: Investor Types Classified Risk Taking And The Way Of Making Download Scientific Diagram |

| Format: PDF |

| Number of Pages: 253 pages 3 Types Of Investors Risk Averse |

| Publication Date: November 2017 |

| File Size: 2.6mb |

| Read Investor Types Classified Risk Taking And The Way Of Making Download Scientific Diagram |

|

2021 Cfa Level I Exam Cfa Study Preparation

| Title: 2021 Cfa Level I Exam Cfa Study Preparation |

| Format: PDF |

| Number of Pages: 204 pages 3 Types Of Investors Risk Averse |

| Publication Date: August 2020 |

| File Size: 1.5mb |

| Read 2021 Cfa Level I Exam Cfa Study Preparation |

|

Utility Function Shapes For Risk Averse Risk Neutral And Risk Seeking Download Scientific Diagram

| Title: Utility Function Shapes For Risk Averse Risk Neutral And Risk Seeking Download Scientific Diagram |

| Format: ePub Book |

| Number of Pages: 182 pages 3 Types Of Investors Risk Averse |

| Publication Date: September 2021 |

| File Size: 725kb |

| Read Utility Function Shapes For Risk Averse Risk Neutral And Risk Seeking Download Scientific Diagram |

|

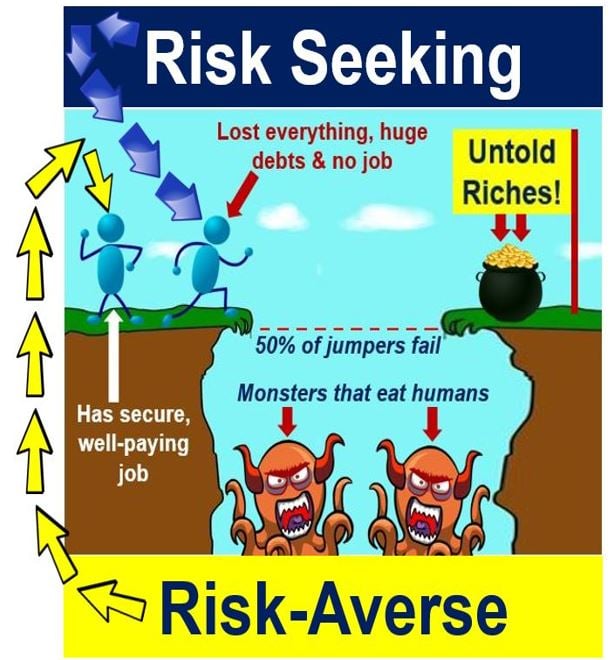

S Marketbusinessnews Wp Content Uploads 2017 03 Risk Seeking Vs Risk Averse Jpg

| Title: S Marketbusinessnews Wp Content Uploads 2017 03 Risk Seeking Vs Risk Averse Jpg |

| Format: ePub Book |

| Number of Pages: 205 pages 3 Types Of Investors Risk Averse |

| Publication Date: August 2021 |

| File Size: 1.8mb |

| Read S Marketbusinessnews Wp Content Uploads 2017 03 Risk Seeking Vs Risk Averse Jpg |

|

Utility To Wealth Function For Different Types Of Investors Download Scientific Diagram

| Title: Utility To Wealth Function For Different Types Of Investors Download Scientific Diagram |

| Format: ePub Book |

| Number of Pages: 289 pages 3 Types Of Investors Risk Averse |

| Publication Date: May 2017 |

| File Size: 1.1mb |

| Read Utility To Wealth Function For Different Types Of Investors Download Scientific Diagram |

|

The Risk Aversion Coefficient Desjardins Online Brokerage

| Title: The Risk Aversion Coefficient Desjardins Online Brokerage |

| Format: PDF |

| Number of Pages: 313 pages 3 Types Of Investors Risk Averse |

| Publication Date: September 2019 |

| File Size: 3.4mb |

| Read The Risk Aversion Coefficient Desjardins Online Brokerage |

|

Indifference Curves And Risk Aversion

| Title: Indifference Curves And Risk Aversion |

| Format: PDF |

| Number of Pages: 208 pages 3 Types Of Investors Risk Averse |

| Publication Date: February 2020 |

| File Size: 1.7mb |

| Read Indifference Curves And Risk Aversion |

|

Different types of risks include project-specific risk industry-specific risk competitive risk international risk and market risk. The third type of investors attempt to control their emotions and increase allocations when asset valuations are bargains and decrease allocations when asset valuations are high. If youre risk averse youll choose low-risk low-reward products.

Here is all you need to know about 3 types of investors risk averse Guaranteed Returns On the principal as well as the return either interest or profits. Investors are risk seeking when losing resulting in a negative risk premium coefficient and risk. Pada dasarnya ada tiga jenis investor bila dihubungkan dengan tingkat risiko yang dapat mereka terima yaitu 1 Tidak senang risiko 2 Netral terhadap risiko 3 Menyukai risiko. The risk aversion coefficient desjardins online brokerage s marketbusinessnews wp content uploads 2017 03 risk seeking vs risk averse jpg investor types classified risk taking and the way of making download scientific diagram utility function shapes for risk averse risk neutral and risk seeking download scientific diagram most important factors influencing investor preference indifference curves and risk aversion Because the investors are rational and are risk averse as such they prefer near dividends than future dividends.

0 Comments